It seems we can’t find what you’re looking for. Perhaps searching can help.

Maritim

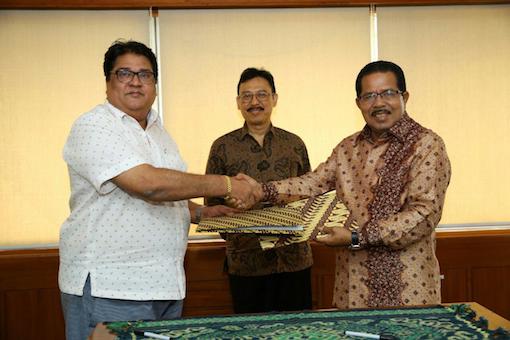

Forses dan Forsesdasi Perkuat

Sinergitas Demi Kemajuan Pembangunan

Maritim

Forses dan Forsesdasi Perkuat

Sinergitas Demi Kemajuan Pembangunan

Maritim

Forses dan Forsesdasi Perkuat

Sinergitas Demi Kemajuan Pembangunan